Corporate Governance

“IRPC is committed to steadfastly operating within the framework of Good Corporate Governance principles in pursuit of operational excellence, transparency, accountability, and benefits to shareholders while making sure stakeholders’ interests are protected.”

Performance:

- “Excellent” CG Rating for 15th Consecutive organized by the Stock Exchange of Thailand (SET) and the Thai Institute of Directors

- “Excellent” rating received for the performance assessment of the Board of Directors and Sub-Committee by an independent appraiser, comparable to the criteria of CGR of listed companies.

Stakeholder Impact

Corporate governance is essential for maintaining transparency, accountability, and ethical behavior within companies. It ensures stakeholders’ trust, enhances business performance, and contributes to long-term sustainability. Within sectors like petroleum and petrochemical, where environmental and social concerns are significant, robust governance frameworks are crucial for promoting responsible conduct, ensuring compliance with standards and regulations, and navigating complexities to achieve operational excellence and create value for society.

IRPC, under the supervisory oversight of the Board of Directors, has prioritized good corporate governance and striven to uphold corporate governance that meets the internationally accepted standards. This commitment aims to ensure operational excellence, transparency, accountability, and shareholders benefits, while protecting the interests of all stakeholders.

Management Approach

Policy

Since 2007, IRPC has established the Corporate Governance Policy as an integral part of our business operations. The company has developed the Corporate Governance Policy and Corporate Governance Handbook as practice guidelines on ethical business conduct, which applies to Board of Directors, executives, and employees of IRPC, including subsidiaries, associates, and joint ventures within IRPC’s management control.

For more information on the Corporate Governance Policy, please refer to IRPC’s Corporate Governance Policy [link]

For more information on Corporate Governance Handbook, please refer to IRPC CG Handbook [link]

Aligned with these guiding principles, the Board has assigned the Corporate Governance and Sustainability Committee to supervise and oversee all aspects of the company’s operations to achieve international benchmarks, in compliance with applicable laws, regulations and guidelines, in alignment with the company’s strategies and business direction. The Committee is also responsible for following up on performance in accordance with the principles of good corporate governance on an annual basis through meetings with a subcommittee which reports the outcomes to the Board of Directors on a quarterly basis.

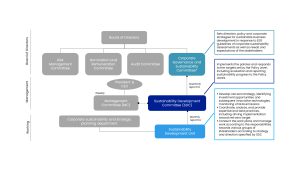

Corporate Governance Structure

IRPC’s governance structure emphasizes efficiency and adheres to principles of good corporate governance. The organizational structure of IRPC comprises shareholders, the Board of Directors, and the management team, led by the Chief Executive Officer and President. The Board is answerable to shareholders, and the management team is accountable to the Board.

The corporate governance structure ensures that the company is managed in the best interests of shareholders. The framework incorporates checks and balances that empower the Board of Directors with appropriate control and oversight responsibilities. Furthermore, management incentives are structured to align with shareholders’ interests.

Board of Directors

The Board plays a key role in defining IRPC’s vision, providing business direction, formulating policies, setting goals, devising strategic plans, and approving annual budgets for implementation by the management to achieve predetermined objectives. Additionally, the Board evaluates risk factors, establishes suitable management approaches, and ensures the credibility of accounting, financial, and audit systems.

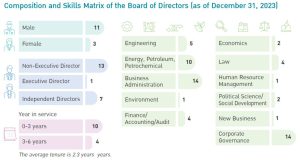

Board Composition

The Board must consist of directors who possess the knowledge, skills, and experience aligned with IRPC’s business interests. They are expected to fully fulfill their duties fully in accordance with their responsibilities. To ensure this, IRPC has defined the composition of the Board, its key qualifications, and the tenure of its members as follows:

- The Board consists of 5-15 directors.

- Professional independent directors must constitute at least one-third of the Board or a minimum of three.

- Directors may be up to 70 years of age.

- A director can serve up to three successive terms (nine years).

The qualifications of an independent director comply with the criteria of the Thai Securities and Exchange Commission (SEC), including no involvement in management functions of the Company and subsidiary, no familial or legal relationship with another director, no business relationships, and not serving as an auditor of the company. In addition, IRPC’s criteria are more stringent than SEC regulations, requiring Independent Director to hold no more than 0.5% of all shares with voting rights of the Company, compared to the SEC’s limit of 1%.

For more information on Board structure, please visit Board of Director [link].

Board’s Committees

The Board consists of four sub-committees, namely the Audit Committee, the Nomination and Remuneration Committee, the Corporate Governance Committee, and the Risk Management Committee, each tasked with overseeing essential aspects of the company.

- Corporate Governance and Sustainability Committee determines and monitors the organization’s annual performance, whether operational or strategic implementation, to ensure that IRPC conforms to the corporate governance and sustainability guidelines. The tasks include key aspects of corporate governance development, environmental governance, and social responsibility.

- Audit Committee reviews the reliability of the financial statements from IRPC and subsidiaries, as well as the internal control system, internal audit system and risk management system to ensure their suitability and effectiveness. Moreover, the Committee provides recommendations on the improvement of the internal control system.

- Nomination and Remuneration Committee recruits qualified candidates to nominate as Board members and the Chief Executive Officer based on the established criteria and procedures that ensures efficiency and transparency, so that the Board is made of directors with diverse knowledge, capability and qualifications. Moreover, the Committee considers compensation for directors and the Chief Executive Officer by adopting equitable and reasonable criteria.

- Risk Management Committee is responsible for overseeing the organization’s risk management. Meanwhile, the Board sets the overall policy, and the Audit Committee review the compliance with these policies. Each committee conducts risk assessment, covering potential impacts to IRPC (both external and internal, including emerging risks, i.e. cybersecurity, environmental and social perspectives), and to provide risk management reports to the Audit Committee and Risk Management Committee for review.

Independent Directors

According to IRPC’s principles of good corporate governance, one-third of the Board of Directors shall consist of independent directors. Both directors and independent directors shall serve a term of three years. Independent directors who complete their term are eligible for reelection by shareholders; however, they may only serve up to three consecutive terms or nine years, with no exceptions. Independent directors must possess the expertise and qualifications for independence pursuant to notifications of the Capital Market Supervisory Board and stipulations of the Board of Directors.According to company policy, independent directors shall hold no more than 0.5 percent of IRPC’s issued shares, a requirement stricter than the 1 percent stipulated by the Securities and Exchange Commission.

The definition of an IRPC independent director is provided in the Corporate Governance Handbook and the company website. Independent directors have the right to express their opinions at every meeting. They are expected to attend meetings regularly and have access to sufficient financial and business information, which enables them to express their thoughts freely and in the best interests of stakeholders. Additionally, they are tasked with preventing conflicts of interest between IRPC and executive officers, authorized directors, and majority shareholders.

IRPC has defined and compared the qualifications of Independents Directors, demonstrating their consistency and higher stringency compared to the requirements of the Stock Exchange Commission (SEC)’s and Dow Jones Sustainability Indices (DJSI)’s criteria.

For more information related to Independent Directors, please refer to IRPC’s Statement on Independent Director [link].

Non–executive Chairman/Lead Director

To ensure effective corporate governance and avoid potential abuses of power, IRPC specifies that the Chairman of the Board and the President must be separate individuals. The primary role of the Chairman is to lead and provide guidance to the company’s Board of Directors, ensuring the highest standards of corporate governance within both the Board and the company, particularly in discussions on all proposals put forward by the management team.

The Chief Executive Officer and President and the Executives

The Board of Directors assigned the Chief Executive Officer and President, the highest-ranking executive of the management, to discharge of his duties in managing the company’s operations in accordance with the objectives, regulations and policies set by the Board.

More information on the criteria for nomination and selection of the President and Chief Executive Officer, please refer to Criteria for Nomination, Selection, Qualifications and Remuneration The President and Chief Executive Officer [link].

Sustainability Governance Structure

IRPC is committed to maintaining a balance between business operations and sustainability across the economic, social, and environmental aspects. In line with this commitment, the Board of Directors has established a governance structure to manage sustainability matters, defining clear responsibilities from the board to operational levels. At the Board level, the Corporate Governance and Sustainability Committee provides guidance and monitors the company’s sustainability development. Meanwhile, the Sustainable Development Committee (SDC) at the management level is tasked with defining and reviewing sustainability policies, approaches, and goals, as well as considering implementation guidelines based on the Board’s directives. The responsibility for implementing these policies lies with the Sustainable Development Unit under the Corporate Sustainability and Strategic Planning Development, in collaboration with relevant functions. The Unit provides monthly reports to the SDC, who then delivers quarterly reports to the Corporate Governance and Sustainability Committee.

Implementation

Board Selection and Nomination Process

The appointment of the Board of Directors aligns with good corporate governance principles and the company’s Corporate Governance Policy. Director candidates are either nominated by shareholders or selected by the Nomination and Remuneration Committee, responsible for screening qualifications and presenting suitable candidates for the Board’s consideration. The Board then presents the list of qualified candidates to shareholders for final approval. In cases of vacancies or resignations, the Board appoints new members based on recommendations from the Nomination and Remuneration Committee.

Nominees for director positions at IRPC are considered based on criteria such as their knowledge, experience, and abilities benefiting the company, as well as alignment with the Board’s skills matrix & diversities in terms of gender, age, race, nationality, expertise, skills & experience, knowledge, and abilities. The process also entails thorough checks on legal qualifications, regulatory compliance, and their demonstrated dedication to fulfilling directorial responsibilities.

For sub-committee appointments, consideration is given to the relevance of knowledge and competencies, tenure criteria, Board Skills Matrix/Diversities, and independent qualifications of directors, which are then brought before the Board of Directors for approval.

For more details on IRPC’s Board Selection and Nomination Process, please refer to the Director Selection & Nomination Process [link]

Board Diversity Encouragement

IRPC supports an appropriate balance and diversity of skills, experience, race and gender within the Board of Directors and has implemented the Board Diversity Policy to ensure transparency of the appointment processes in compliance with Corporate Governance Policy. This aims to create a well-rounded leadership team with both the technical skills and experience needed for the energy industry, while also ensuring diversity in social background, race, gender, religions, and other aspects. The policy mandates the Nomination and Remuneration Committee to address Board vacancies by actively considering candidates who bring a diverse background and opinion from among those candidates with the appropriate background and industry or related expertise and experience as well as achieving an appropriate level of diversity.

For more information on Board Diversity Policy, please refer to Policy of Board Diversity in the Directors Nomination Process [link].

For more information on the employee diversity policy, please refer to Diversity and Inclusion Policy [link].

Board Industry Experience

According to IRPC’s Corporate Governance Handbook, the Board should comprise at least three directors with expertise in the petroleum and petrochemical industries, at least one with expertise in law, and at least one with expertise in accounting or finance. The following factors, as stipulated in the nomination policy and criteria, should be considered: educational background, management skills in their respective fields, and significant achievements and recognition within the comparable scale of business.

For more information on Board Industry Experience, please refer to Board Skill Matrix [Link]

Board Effectiveness and Compensation

IRPC determines that the evaluation of Board performance, including assessments of the Board of Directors, subcommittees, and individual directors, is conducted annually to facilitate a comprehensive review of performance, challenges, and achievements throughout the preceding year. The performance assessment of the Board, as outlined in the Corporate Governance Handbook, is conducted in both forms of self-evaluation and cross-evaluation methods. Additionally, the performance assessment is evaluated by an external assessor every 3 years (Independent Assessment) and the results of such evaluation are to be reported to the Corporate Governance Committee, shareholders, and disclosed in the annual report. The assessment results are also utilized to drive further performance improvements. In addition, IRPC encourages our directors and executive officers to attend training programs that are beneficial to the performance of their duties, enabling them to enhance their skills, stay updated on industry trends, and effectively fulfill their responsibilities.

For more information on the process and results of the Board’s performance assessment, please refer to Corporate One Report [link]

The Nomination and Remuneration Committee is responsible for reviewing Board compensation, providing recommendations to the Board for approval, and proposing the compensation amount at the annual general meeting for shareholder’s approval, ensuring transparency and adherence to the Compensation Best Practices released by the Thai Institute of Directors Association.Director compensation is linked to short- and long-term corporate strategies, ensuring compensation packages are appropriate commensurate to the size and complexity of IRPC’s business.

Success Metrics for the Chief Executive Officer and President Compensation

The Board of Directors has stipulated that the president of IRPC shall submit an annual performance report, which is assessed by the Nomination and Remuneration Committee. Subsequently, the Board utilizes the results of this review to determine the CEO and President’s remuneration. However, these assessment outcomes are treated as confidential information. The criteria for evaluation encompass challenging targets in accordance with the company’s short-term and long-term strategies, covering both monetary and non-monetary performances, including social, community, and environmental responsibilities. The CEO and President is responsible for managing the business and steering the organization forward, guided by two assessment indicators: corporate KPIs, accounting for 70% of the evaluation, and supporting factors that enhance the company’s transparency and sustainability, comprising the remaining 30%.

| Corporate KPIs (70%) | Sustainable Growth Factors (30%) |

|

|

For more information on the Corporate KPI, please refer to [Link]

The adjustment of salary and annual bonuses for the CEO are dependent on the results of the performance review and are subject to the approval of the Board of Directors. In addition to challenging targets, these criteria comprehend key performance indicators of the company’s strategic plan and vision, corporate responsibilities for communities, society, and the environment, as well as a Balanced Scorecard. The remuneration of IRPC’s CEO and President is comparable to that of others within the same or similar industries.

Moreover, IRPC compares the company’s performance assessments with other companies in the same industry, particularly concerning financial indicators, to evaluate the CEO and President’s compensation relative to the organization’s financial performance. IRPC calculates our financial metrics and those of peers over a three-year period. This assessment compares the weighted average performance rank with the salary rank of IRPC’s CEO and president relative to peer company presidents. The comparison provides insights into IRPC’s relative financial performance.

CEO and Executive Compensation

IRPC discloses the fixed and variable compensation of the CEO and executives as follows:

Renumeration (Million Baht) |

Executive Level 1 |

|||

2020(7 executives) |

2021(6 executives) |

2022(8 executives) |

2023(6 executives) |

|

Compensation |

||||

| Salary | 33.59 | 30.85 | 36.15 | 35.24 |

| Bonus | 15.3 | 6.7 | 18.7 | 6.5 |

Other compensation |

||||

| Provident fund contribution | 4.66 | 4.42 | 5.21 | 5.15 |

Total |

53.55 |

41.97 |

60.06 |

45.62 |

Note:1. Executive Level 1 definition according to the Securities and Exchange Commission consists of : i) President and CEO; ii) Senior Executive Vice President of Corporate Accounting & Finance, Corporate Strategy, Corporate Commercial and Marketing, Corporate Organization Effectiveness, Innovation and Operation Excellence, and Petrochemical and Refinery Operation. 2. The total President’s remuneration included from IRPC and PTT.

In addition, IRPC provides disclosure of the mean and median annual compensation of all employees, along with the ratio between the mean and median employee compensation and the total annual compensation of the CEO, as presented in the table below.

Compensation (THB) |

2020 |

2021 |

2022 |

2023 |

| Total annual compensation of the CEO | 11,215,592 | 16,427,919 | 19,826,122 | 13,312,803 |

| Median annual compensation of all employees, except the CEO | 1,170,690 | 1,156,338 | 1,585,298 | 1,242,282 |

| Mean annual compensation of all employees, except the CEO | 1,366,733 | 1,273,372 | 1,882,039 | 1,343,906 |

| Ratio between the total annual compensation of the CEO and the median employee compensation | 11.08 | 10.49 | 7.12 | 10.72 |

| Ratio between the total annual compensation of the CEO and the mean or employee compensation | 9.49 | 9.53 | 5.99 | 9.91 |

Clawback Provision

IRPC’s Clawback Provision is established in accordance with the Securities and Exchange Act B.E. 2535, Section 89/7. Under Section 89/7, executive management is entrusted to managing the company with due diligence and integrity, and in compliance with laws, the company’s objectives, regulations, and resolutions from both the Board and shareholders’ meetings. Additionally, the executive management can face prosecution under Section 89/18 without conflicting with section 89/19 if it can be proven that they have not been performing their duties according to 89/7 or have engaged in direct or indirect misconduct. In such cases, executive management and any implicated individuals are required to return any benefits they have received.

Management Ownership Encouragement

To foster a sense of individual ownership, which is part of corporate’s desired behavior and a theme of IRPC DNA, our CEO has encouraged IRPC employees, particularly executive members, to voluntarily acquire shares of IRPC. This initiative aims to deepen their commitment and establish long-term trust with our investors. Nonetheless, all must adhere strictly to the regulations established by the Securities and Exchange Commission to prevent insider trading or unethical behavior.

President and other executive officers hold company shares (as of Dec 2023)

Position |

Name(s) |

Multiple of base salary |

| President and CEO | Mr. Kris Imsang | 0 |

| Average for other executive committee members | IRPC’s Executive level refer to the position that has one level below president position, which is equivalent to senior executive vice president level.

Names of IRPC’s executives that hold IRPC shares are as follows: Mr. Pranarch Kosayanont Ms. Wanida Utaisomnapa |

2 |

Conflict of Interest Prevention

The Board of Directors arranges for individual directors and executives to file their potential conflicts of interest for use as basic information to provide oversight on this matter. The reports are then forwarded to the Company Secretary who retains, gathers the reports and then submit copies to the Board Chairman and chairman of the Audit Committee as reference in examining and supervising conflicts of interes

In addition to adhering to SEC Office regulations regarding the disclosure of directors’ and executives’ conflicts of interest, IRPC mandates that all directors, executives, and employees, including those of subsidiaries, joint ventures, and companies where IRPC has controlling stakes, disclose any potential conflict of interest in transactions involving IRPC or IRPC Group.

Reporting Securities Holdings

The company mandates that Board members and executive officers, along with their lawful spouses, cohabiting partners, and underage children, report any changes in their holdings of IRPC securities to the company, the Stock Exchange of Thailand, and the SEC Office within three business days of any transaction. Additionally, they are required to disclose such trades to the Board on a monthly basis. The company also has a policy to impose Blackout Period to prohibit trade in IRPC securities for a period of 30 days prior to and within two days after public disclosure of the company’s financial statements.

In 2023 and over the past five years, no directors or executive officers have been involved in any wrongful activities under the Securities and Exchange Act B.E. 2535 (1992) or Derivatives Act B.E. 2546 (2003), or any record of the following:

- Dishonesty or severe negligence;

- Disclosure or dissemination of false information or messages that could lead to misunderstanding, or concealing essential facts that should be disclosed, both of which could affect the decisions of shareholders, investors, or concerned parties;

- Unfairness or taking advantage of investors in the sale and purchase of shares or derivatives, or playing a part in supporting such activities.

For more information on security holdings of executives, please refer to assessment, please refer to Corporate One Report

Voting Rights

IRPC’s policy stipulates that each share entitles the holder to one vote, and the company does not issue golden shares or dual class shares under any circumstances. With regard to non-voting depository receipts (NVDRs), NVDR holders cannot be involved in company decision-making, therefore, the holders cannot be granted voting rights. The definition of NVDR can be found on Stock Exchange of Thailand’s website [link]

Performance Summary

Live Stream

Live Stream