Business Ethics and Transparency

“IRPC is committed to good corporate governance principles while emphasizing on operational excellence, morality, transparency, verifiability and free from frauds or corruptions”

| Target: | Performance: |

| No material operational non-compliance and fraud incident. | No material operational non-compliance and fraud incident was detected in 2023. |

Stakeholder Impact

Business ethics and compliance are essential pillars of responsible corporate behavior, guiding ethical decision-making and sustainability. Upholding ethics builds trust, enhances reputation, and ensures legal adherence, fostering transparency and accountability. A strong ethical culture can also boost employee loyalty and productivity, creating a positive work environment.

With our extensive business operations touching numerous stakeholders, IRPC is committed to operating its businesses under good corporate governance principles while emphasizing on operational excellence, morality, transparency, verifiability, free from frauds or corruptions. Business ethics and compliance is a key element of our corporate governance policy, serving as our moral compass governing every business activity and interaction with stakeholders. This ensures that we uphold the highest standards of integrity and responsibility in all our endeavors.

Management Approach

Policy

To complement the Corporate Governance Policy and Corporate Governance Handbook which forms the foundation of our governance framework, IRPC launched additional policies, including the Anti-Corruption Policy and Compliance Policy to underscore our firm commitment to upholding business ethics and integrity in all aspects of our management practices.

More information on IRPC’s Anti-Corruption Policy, please visit [link].

More information IRPC’s Compliance Policy, please visit [link] and [link].

Responsible Functions

The Corporate Governance and Sustainability Committee is tasked with monitoring and overseeing management practices to ensure compliance with good corporate governance principles. This includes tracking the efficiency and implementation of the Anti-Corruption Policy and other policies relevant to Good Governance, Risk Management, and Compliance Management (GRC).

To ensure that the company has appropriate and effective internal control system in place, the Audit Committee is responsible for monitoring the company’s business operations to ensure compliance with IRPC’s Corporate Governance handbook and the relevant laws and regulations. In addition, IRPC engages with an external independent audit committee to conduct thorough and meticulous investigations within the scope and authority defined by the Board.

Implementation

Believing that business ethics foster public confidence and trust, IRPC adheres to our code of conduct, aiming to achieve a balance among the business objectives of transparency, auditability, and stakeholders’ stewardship to ensure sustainability.

Code of Conduct

Our company values, principles, and guidelines on business code of conduct are outlined in our Corporate Governance Handbook. Recognizing the importance of ethical business conduct, IRPC has integrated business ethics as one of the key elements in our Corporate Governance Policy, including definitions and guidelines on its application in our day-to-day operations. At IRPC, business ethics covers the following key aspects.

- Responsibility to shareholders

- Relationships with customers and the public

- Relationships with suppliers, business competitors and creditors

- Responsibility to employees

- Responsibility to society and the environment.

IRPC requires that all employees complete acknowledgement and conformity forms, which are then submitted to the Office of Corporate Affairs. Moreover, IRPC has organized awareness campaigns and educational activities, such as corporate governance workshops, new employees’ orientation, PTT Group CG Day, IRPC CG Day, IRPC CUBIC Academy Season, No Gift Policy and Anti-Corruption campaigns, training courses, and periodic reviews via the e-learning system to communicate and promote compliance with good corporate governance principles and business code of conduct.

In addition, IRPC distributes Corporate Governance Handbook principles and guidelines to business partners, joint ventures, and entities in which IRPC holds shares of less than 51%, as well as other business associates. For joint ventures, IRPC requires joint ventures to maintain their own code of conduct, which should be at least equivalent to IRPC’s Corporate Governance Handbook. In instances where a joint venture lacks its own code of conduct, IRPC mandates the adoption of IRPC’s Corporate Governance Handbook by our joint ventures.

More details of IRPC code of conduct is outlined in Corporate Governance Handbook [link]

Remark: Anti-corruption is covered in IRPC’s training and communications regarding the organization’s ethics and business code of conduct, and the percentage presented represents the total coverage of this topic in our communication and training efforts.

Compliance System

IRPC has consistently adopted the integrated Governance, Risk Management/Internal Control, and Compliance (GRC) framework in our management approach. This comprehensive approach enables the company to effectively identify, assess, and mitigate risks while ensuring adherence to all applicable laws and guidelines. To ensure seamless implementation, the company has also established a GRC working group to actively engage in activities aimed at promoting better understanding and integration of GRC principles among employees, with dedicated help desks and focal points assigned for assistance. Activities relating to GRC were reported to the GRC committee every two months and to the Corporate Governance and Sustainability Committee every quarter.

More information on IRPC compliance system, please refer to Compliance Systems [link]

Anti-corruption

The company is committed to eliminating corruption, bribery, and coercion in all forms by building knowledge and promoting understanding among personnel at all levels and throughout the supply chain. The Board of Directors has set out concrete anti-corruption policies and practices, such as anti-graft, anti-corruption, anti-bribery policies, no-gift policy. These policies are applicable to all IRPC and IRPC Group personnel, with training and occasional campaigns implemented to raise awareness. IRPC also expends the anti-corruption network to include stakeholders, such as other IRPC Group companies, joint-venture partners, and contractors.

In addition, The Audit Committee includes corruption risk management and assessment on its corporate internal audit agenda. The scope of risk assessment covers all IRPC business activities. The assessment highlights significant risks in activities such as company’s operations, all of which are included in the Corruption Risk profile with determined preventive measures. The committee also requires corruption risks to be controlled, monitored, assessed, and reported to the Board on a regular basis.

For more information on IRPC anti-corruption activities, please refer to “Creating Corporate Governance Mindset and Awareness” in the Corporate One Report [Link]

Reporting on breaches

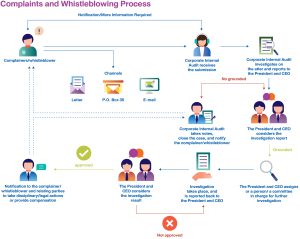

IRPC strictly implements the defined code of conduct, with designated units responsible for clear execution. Help desks and channels for complaints and grievances are provided to all internal and external stakeholders, alongside clearly defined, unbiased, and transparent investigation and resolution processes. Both internal and external stakeholders can directly communicate with the Chairman of the Audit Committee and Corporate Governance and Sustainability Committee through various whistleblowing channels, including telephone, company website, email, and PO Box. The company accepts submissions about any activity that violates the law or code of conduct, or any corrupt practice or inappropriate conduct of any person at any level, from directors, executive officers to employees of IRPC or subsidiaries, stakeholders, or parties related to IRPC’s businesses Additionally, measures are in place to protect whistleblowers and relevant witnesses in accordance with the commitment stated in the Whistleblowing Policy.

Whistleblowing Channels

All complaints are directed to the Internal Audit Office for initial screening. If unrelated to corruption, they are forwarded to the Complaint Screening Committee, who will conduct a preliminary evaluation, gathers evidence, prepares a report for the CEO and relevant committee, and updates the complainant on progress as per company procedures. If a complaint concerns corruption, the Internal Audit Office will handle it and take further actions, along with gathering evidence and reporting directly to the Audit Committee and Board of Directors. The Internal Audit Office will determine the complaint’s merit and may appoint an investigation committee. If it is found that a wrongdoing has been committed, disciplinary actions will be taken against the offender according to the company’s regulations. The company also summarizes complaint data, analyzes causes and risks, and review them to determine additional appropriate control processes.

Since 2022, IRPC has enhanced the rules on handling of complaints and whistleblowing of IRPC and subsidiaries to make sure they are in alignment with the corporate governance principles and internationally accepted standards. This effort also involves gathering feedback from stakeholders and incorporating it to enhance the company’s whistleblowing process and system.

Consequence of Breaches

IRPC has defined penalties in case of legal or regulatory violations in a fair and transparent manner in all circumstances. The Internal Audit Committee and relevant business are responsible for reviewing and reporting incidents to the Audit Committee and the Board of Directors, as well as to related departments, in the sequence specified in the Complaint Management Procedure.

Organization Contributions

The risk posed by changes in legal requirements can significantly impact IRPC’s current and future operations. Therefore, IRPC actively collaborates with regulators to advance the principles of sustainable development, protect our rights, and strengthen our position as a leading integrated petrochemical complex in Asia. In doing so, IRPC adheres to Sub-Element 6.3 Regulatory Advocacy of the PTT Group Sustainability Management Framework, ensuring independence and transparency in all communications and interactions with regulators and policy makers.

In addition, IRPC supports national and international associations and organizations to advocate for public policies and regulations that enhance sustainability practices and assist policymakers through experience and information sharing on sustainability both internally and externally. However, IRPC has established an Anti-corruption Policy to clarify our position as politically neutral, which means we do not directly or indirectly support any political parties or politicians, but fully supports compliance with the law and democratic rule. Although the Board of Directors, executives, and employees have political freedom under the law, IRPC prohibits any form of expression that may adversely affect the organization’s reputation.

For more information, please refer to the Corporate Governance Handbook, Section 3 Anti-corruption Policy [Link].

Below is a table presenting IRPC’s monetary contributions to trade associations or tax-exempt groups over the past four years. The scope of contribution covers 100% of total spending.

| Type of Organization | Name of Organization | Amount Paid (THB) | Total Amount (THB) | |||

| 2020 | 2021 | 2022 | 2023 | |||

| Lobbying, interest representation or similar | – | 0 | 0 | 0 | 0 | 0 |

| Local, regional, or national political campaigns / organizations / candidates | – | 0 | 0 | 0 | 0 | 0 |

| Trade Association or Tax-exempt Group | Oil Industry Environmental Safety Group Association | 4,766,000 | 4,302,000 | 4,654,234 | 1,079,000 | 14,801,234 |

| Thai Institute of Directors (IOD) | 500,000 | 500,000 | 500,000 | 500,000 | 2,000,000 | |

| Responsible Care Management Committee of Thailand, Chemical Industry Club of the Federation of Thai Industries (RCMCT) | 336,000 | 308,600 | 312,670 | 323,800 | 1,281,070 | |

| Thailand Business Council for Sustainable Development | 250,000 | 250,000 | 250,000 | 250,000 | 1,000,000 | |

| Anti-Corruption Foundation | 1,000,000 | 1,000,000 | 1,000,000 | 1,000,000 | 4,000,000 | |

| Foundation for the Global Compact | 470,312 | 480,435 | 528,750 | 688,214 | 2,167,711 | |

| Petroleum Instituted of Thailand | 470,800 | 440,000 | 440,000 | 440,000 | 1,790,800 | |

| Total Contributions | 7,793,112 | 7,281,035 | 7,685,654 | 4,281,014 | 27,040,815 | |

Largest Contributions and Expenditures

To demonstrate our transparency in political contributions, IRPC discloses information about contributions that create or influence public policy on our corporate website. Two key issues that IRPC consistently supports are below:

| Key Issue | Corporate Position | Description of Position/Engagement | Total Spending in FY 2023 (THB) |

| Responsible business operation for long-term business success and support a development of sustainable petroleum and petrochemical industries |

Support |

IRPC recognizes sustainability as a cornerstone of its business strategy and a key factor in achieving its corporate goals. Committed to enhancing performance in governance, safety, and environmental protection, IRPC actively participates in developing industry regulations that benefit the entire sector. By aligning with global sustainability trends and international best practices, IRPC aims to operate its business in accordance with these regulations. |

1,500,000 |

| Driving sustainability toward net zero carbon business |

Support |

IRPC is committed to achieving net zero emissions both for the company and the nation. To accomplish this, the company has joined industry councils to gain expertise in reducing its carbon footprint and making positive environmental and social contributions. IRPC is also actively involved in advocating for climate-related regulations. As a founding member of the Global Compact Foundation in Thailand and an executive committee member of the Thailand Business Council for Sustainable Development, IRPC demonstrates its leadership in promoting sustainable practices. All financial contributions to these organizations are transparently disclosed. |

2,781,014 |

IRPC maintains political neutrality and contributes zero financial support to any political party, political group or any political candidates, neither in any local, regional nor national levels, or person with political influence. In addition, IRPC is well aware that contributions and charitable donations may impact the company’s reputation through risks of bribery or corruption. Hence, the company strictly follows our Anti–corruption Policy to prevent the risk that our contributions or charitable donations become associated with bribery or corruption.

Membership of Associations (Other Large Expenditures)

In the fiscal year of 2023, IRPC made contributions to the following organizations that are related to trade associations or tax-exempt groups:

1. Oil Industry Environmental Safety Group Association

– to participate and support related authorities in adopting new regulations, engage in education and training to promote safety and the best environmental practices among members, and collaborate with the government and organizations on oil spill response activities.

2. Anti-Corruption Foundation

IRPC actively supporting its anti-corruption initiatives, implementing robust transparency and accountability measures within the company, fostering a culture of integrity among employees, and participating in the Foundation’s awareness campaigns. By demonstrating a strong commitment to ethical practices, IRPC can influence the Foundation’s agenda and contribute to a broader anti-corruption ecosystem.

3. Foundation for the Global Compact

IRPC is one of the founding members of UNGC Local Network Thailand, with the objective of supporting the Principles of the UN Global Compact on human rights, labor, environment, and anti-corruption. Progress is reported to the UNGC to align with the United Nations’ Sustainable Development Goals. The network facilitates knowledge sharing on human rights, corporate governance, and anti-corruption aspects.

4. Thai Institute of Directors

IRPC collaborate with the Thai Institute of Directors to enhance its corporate governance by developing director skills, assessing governance practices, sharing knowledge, influencing policy, and leveraging IOD’s reputation to build investor confidence and contribute to Thailand’s overall corporate governance landscape.

5. Petroleum Instituted of Thailand

IRPC engage in dialogue with PTIT and peers in the petroleum and petrochemical industries to promote sound and practical policies and regulations.

A Catalyst for Climate Action Through Partnership and Trade Associations

Leveraging Leadership Positions

Given IRPC’s CEO’s role as an executive committee member in the Thailand Business Council for Sustainable Development (TBCSD) and the company’s commitment to net zero through Global Compact Network Thailand Forum, it is well-positioned to be a leading voice in climate action. This strategic positioning allows IRPC to significantly influence policy, industry standards, and public perception.

Detailed Strategies for Climate Alignment

1. Policy Advocacy:

IRPC can significantly influence the policy landscape in favor of a low-carbon transition through strategic engagement. By directly lobbying policymakers and actively participating in industry associations like TBCSD and GCNT, IRPC can advocate for policies that support its sustainability goals while contributing to Thailand’s broader climate objectives. Proactive monitoring of regulatory developments will enable IRPC to capitalize on opportunities and mitigate potential risks associated with the evolving policy environment.

In essence, IRPC’s involvement in the policymaking process positions the company as a key player in shaping the future of sustainable business in Thailand.

2. Industry Collaboration:

IRPC can drive significant industry-wide progress on climate change through collaboration and knowledge leadership. By sharing its experience with the Thailand Business Council for Sustainable Development (TBCSD) and GCNT, IRPC can inspire and guide other companies in adopting sustainable practices. Collaborative projects on renewable energy, carbon capture and storage, or even forestation initiatives, can accelerate industry-wide decarbonization efforts. Furthermore, by encouraging its suppliers to adopt sustainable practices, IRPC can extend its positive impact beyond its own operations and create a more sustainable supply chain ecosystem.

By taking a collaborative approach, IRPC can foster a powerful movement within the Thai business sector towards a low-carbon future.

(For more information please go to public website of Thailand Business Council for Sustainable Development, https://www.facebook.com/tei.or.th)

3. Public Engagement:

Effective communication is essential for IRPC to build a strong reputation as a climate leader. By developing a clear and compelling communication strategy, engaging with key stakeholders, and leveraging media opportunities, IRPC can enhance its brand image, build trust, and garner public support for its climate initiatives. This strategic approach will be instrumental in driving positive change and inspiring others to join the fight against climate change

4. Research and Development:

To achieve substantial reductions in carbon emissions, IRPC must prioritize innovation. By investing in research and development and forging partnerships with academic and research institutions, IRPC can accelerate the development and deployment of low-carbon technologies and solutions. This strategic focus on innovation will position IRPC as a technology leader and drive sustainable growth.

By effectively utilizing its leadership positions and implementing these strategies, IRPC can play a pivotal role in driving Thailand’s transition to a low-carbon economy while enhancing its reputation as a responsible corporate citizen.

Tax Strategy

IRPC strictly adheres to the principles of transparency and fairness. When addressing tax-related matters, these principles are ingrained at every level of our organization, ensuring consistency in tax approaches across all IRPC Group companies and always promoting good governance and accountability. In line with this commitment, our tax policies are built upon four pillars:

Tax Code of Conduct: We strive to achieve sustainable and competitive company taxation, fostering value and growth, while demonstrating good corporate tax citizenship with added value for the society. Our principles include:

- Manage taxation for the benefits of stakeholders by paying tax properly as required by law.

- Taxes are applicable where the economic activities that generates the profits are performed.

- Beware of direct and indirect risks from aggressive tax planning; avoid using contrived or abnormal tax structures that are intended for tax avoidance and have no commercial substance.

- Transactions between related parties are based on arm’s length principle to ensure that the fair share of taxes is paid with respect to our function performed and our business strategies.

Tax Alignment with Corporate Strategy and Business Goal: IRPC pursues a tax strategy that is principled, transparent and sustainable in the long term and considers tax impact for investments and new transactions. Additionally, IRPC explores tax incentives/exemptions available for our commercial activities for the benefits of our stakeholders.

Tax Risk Management: IRPC considers tax risks to ensure that they are identified, managed, and reported to the management. We ensure that our tax positions align with relevant laws. We also regularly review relevant laws to address emerging risks.

Tax Transparency: We are committed to timely submitting all relevant tax information to governing authorities, enhancing transparency in our tax affairs, and fulfilling all statutory disclosure requirements on taxation.

IRPC Group Tax Strategy and Tax Policy have been approved and endorsed by the Board of Directors. The Accounting Department has been designated to oversee the development and implementation of tax-related initiatives, ensuring compliance and effective management of tax matters.

For more information on IRPC Group Tax Policy, please visit [Link].

Tax Reporting

In order to emphasize our transparency and corporate governance, taxes paid to Thailand, which only one country where IRPC has operated business, are disclosed. Revenue, operating profit, and tax paid for the Year 2021 as shown below.

Financial and tax information for each tax jurisdiction publicly reporting. IRPC’s Group operations being based in Thailand only.

[Click] for Tax Reporting in 2023

| Financial Reporting | FY 2022 | FY 2023 | Calculated Average Rate |

| Earnings before Tax (Loss) | (5,501,824,833) | (3,684,246,386) | |

| Reported Taxes | -1,141,807,919 | -771,892,957 | |

| Cumulative acceptable adjustments* | 0 | 0 | |

| Effective Tax Rate (%) | 20.75326 | 20.95118 | 20.83264 |

| Cash Taxes Paid | 2,495,312,949 | 171,300,292 | |

| Cash Tax Rate (%) | -45.35428 | -4.64953 |

Remark: *‘Cumulative acceptable adjustments’ will be calculated based on amounts in two of the ‘reasons’; 1. Group-wide net operating losses; 2. Single jurisdiction tax code

IRPC operates business with transparency which complies with applicable laws as good corporate tax citizenship with our aim to add value for all stakeholders. Those two reasons for the lower ‘reported tax’ rate is explained below:

The lower ‘reported tax’ is attributed to the single jurisdiction tax code, with lower rates for Thailand compared with industry average: Revenue Code Amendment Act No. 42 B.E. 2559 dated 3 March 2016 grants a reduction of the corporate income tax rate to 20% of net taxable profit for accounting periods which begin on or after 1 January 2016.

According to IRPC’s financial statements, the income not subject to tax is made up of:

- Dividends from the Stock Exchange and subsidiaries, which are recognized as income but are not subject to tax according to Code of Revenue Section 65 Bis (10).

- The Investment Promotion Act B.E. 2520 (1977) and its subsequent amendments, notably the Investment Promotion Act (No. 4) B.E. 2560 (2017), enable the Board of Investment (BOI) to grant promoted companies tax exemptions of up to 13 years for high-tech, innovation, and R&D businesses, which also entail exemptions from import duties and the ability to carry forward tax losses incurred during the tax-exemption period.

IRPC has been granted privileges by the Board of Investment. Full details are included in the Corporate One Report [Link], including the duration of the privileges and affected revenues.

Performance Summary

In 2023, IRPC received a total of 20 cases through the whistleblower system, comprising 19 cases of performance, behavior, and recommendations, and 1 case of non-compliance with the company’s codes of conduct. These cases are further categorized into 1 case related to corruption, 0 case related to discrimination or harassment, 0 case related to customer privacy data, 0 case related to conflicts of interest, and no care related to Money Laundering or Insider trading. As a result of a corruption case involving an employee and a contractor, the company terminated the employee without severance pay. The company issued a written warning to the supervisor of the accused department. The involved contractor was blacklisted. Legal action for embezzlement was taken against both the employee and the contractor.

Out of the 20 cases, all cases have been resolved, 18 cases are unfounded complaint, with resolutions including 1 cases of verbal warnings, 0 case of official written warnings, and 1 case of contract terminations.

The responsible functions have been notified to provide preventive measures, for example, to raise awareness on corporate culture and desired behavior, to build good relationship in each function through activities, to conduct “feedback” session for employees and their subordinate to make open minded conversation, and to conduct the Corporate Governance, Business Ethics and Compliance awareness raising training program, periodically.

|

|

Complaint Channel | Type | Preliminary

investigation |

Case status |

||||||

| E-mail

& Postal |

PO

Box 35 |

Web

site |

Supervisor | – Performance

– Behavior – Suggestion |

Corruption | Completed | Ongoing | Resolved | In progress | |

| 1 | 8 | 1 | 10 | 19 | 1 | 20 | – | 20 | – | |

| total | 20 (100%) | 20 (100%) | 20 (100%) | 20 (100%) | ||||||

| % | 10 | 80 | 5 | 95 | 95 | 5 | 100 | – | 100 | – |

Details on historical data of substantiated whistleblowing cases for the past four years are presented in the performance summary report [Link]

Live Stream

Live Stream