2567-08-7

IRPC Reports 812 Million Baht Profit, Expands Globally

IRPC’s first-half 2024 performance shows 1% revenue growth, with strategic focus on high-quality Jet A1 fuel and environmentally validated petrochemicals driving global expansion.

IRPC showcases a net revenue of 148,710 million baht in the first half of 2024, increasing 1% compared to the first half of 2023. The performance results from a 9% increase in selling price, following the higher oil price, and profits generated by oil stocks of 2.138 billion baht. The EBITDA is accounted for at 6.118 billion baht, increasing by 187%, driving a net profit of 812 million baht. IRPC is prompted to move forward with business expansion, highlighting Jet A1 compliant with JIG standards to support the aviation industry worldwide.

IRPC Public Company Limited, or IRPC, led by Kris Imsang, Director, President, and Chief Executive Officer, announced the 2024 IRPC performance: “IRPC has achieved market expansion focusing on high-quality Jet A1 oil certified by JIG (Joint Inspection Group). The market growth in Vietnam affirms the manufacturing capacity of high-quality products in line with global demand, adding value and revenue for the company.”

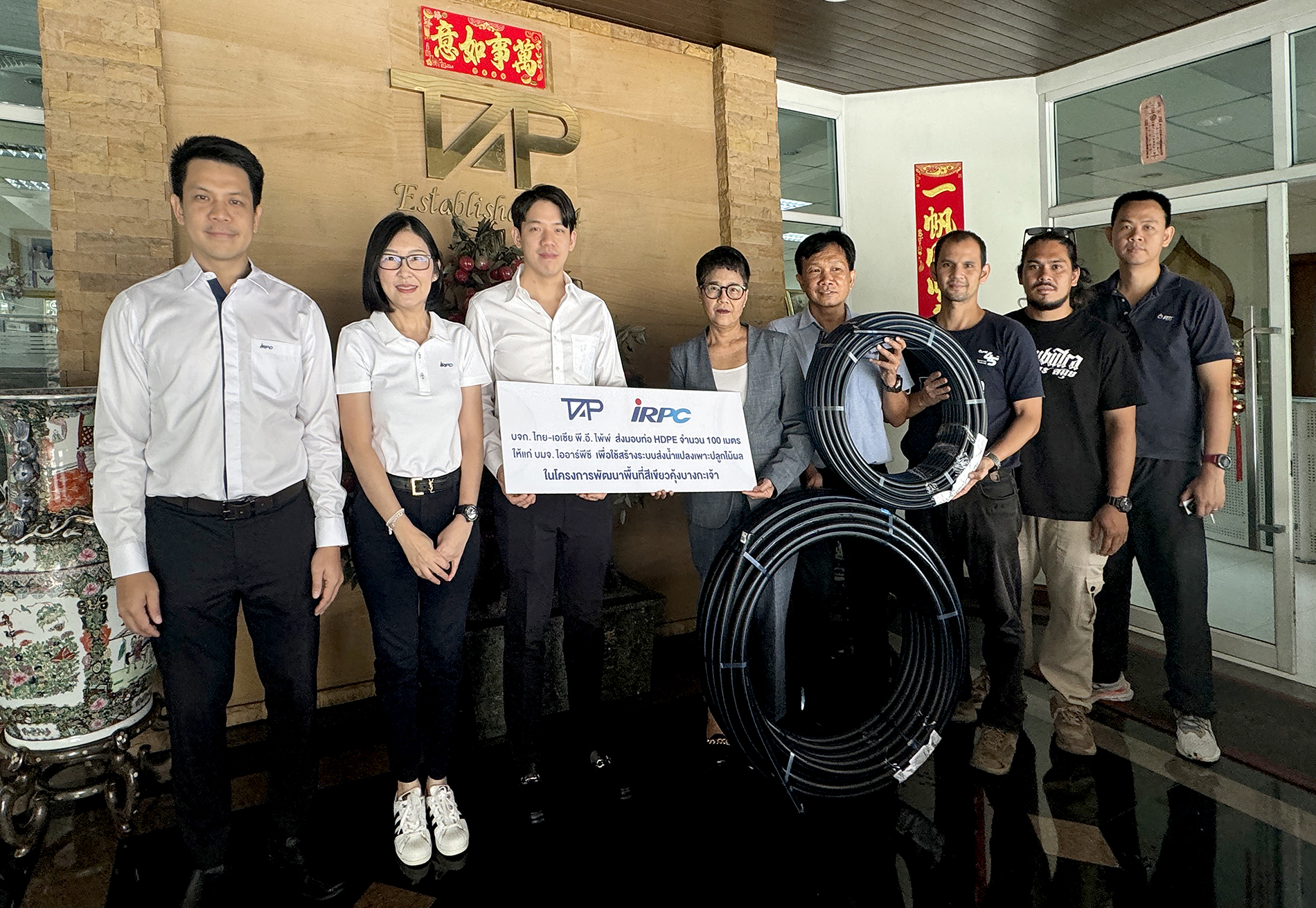

The petrochemical business advancement includes four grades of Polypropylene “POLIMAXX”, namely K4510B, K4520UB, K4527B, and 1140VC, with Thailand’s first approval of UL Environmental Claim Validation (ECV) label from Underwriters Laboratories or UL, United States. The certified credit has confirmed the company’s commitment to technology engagement to develop products and prioritise environmental impacts.

IRPC extends investment in an Advance Materials company, Cleantech & Beyond Company Limited with a collaborative endowment between IRPC Intellectual Property (IP) and VISTEC to seek new business opportunities in Starup industries while expanding the long-term growth to meet megatrends aligning to the company’s step up & beyond strategy.”

In addition, IRPC signed the MoU in collaboration with “Krung Thai Bank” and “Siam Commercial Bank”to advance ESG-Linked FX Total Solutions Program with the foreign exchange management innovation to enhance the financial management with efficiency and risk management, supporting IRPC to achieve the sustainability goals. The ESG-Linked FX Total Solutions Program is a financial derivatives innovation with resources based on environmental, social, and government performances related to the sustainability development framework of the company.

Kris added “The oil market outlook in Q3/2024 projects the increasing demand supported by the demand surge of benzine output production during driving season and fuel oil demand for the electricity generation during summer in the Middle East countries. Meanwhile, the conflicts arisen worldwide remain the significant issues to stir uncertainties in crude oil market.”

The petrochemical market in Q3/2024 marks the increasing of higher new manufacturing outputs than the petrochemical products demand. Therefore, the prices among olefin prices experience pressures while demands among Styrenics category, particularly ABS has undergone recovery during the last quarter as the petrochemical business has entered the manufacturing season.

Live Stream

Live Stream