2568-02-11

IRPC Powers Growth with Innovation and Sustainable Energy

IRPC advances clean energy and specialty materials to drive growth amid global challenges and shifting regulations.

IRPC Public Co., Ltd., led by President and CEO Terdkiat Prommool, is leveraging its expertise in petroleum, ports, and property businesses while expanding into new opportunities in innovative materials and sustainable energy. Despite the challenges posed by economic volatility and global uncertainties, IRPC is determined to achieve growth through capacity enhancement, cost reduction, and maximising asset utilisation.

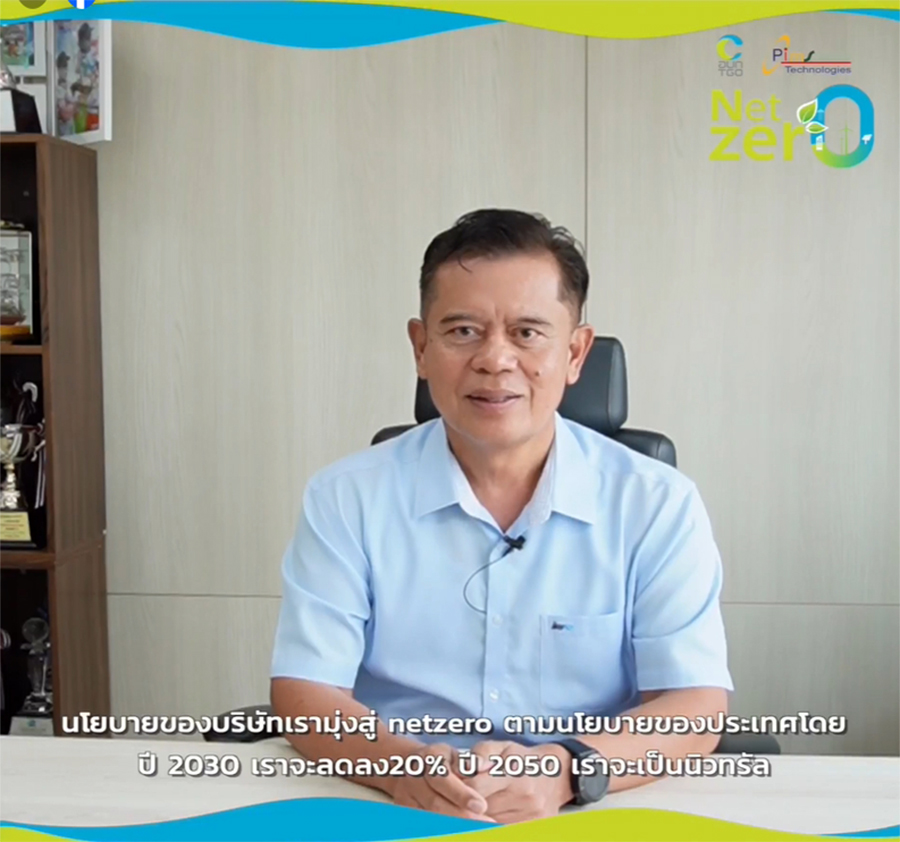

“IRPC is focused on fostering growth by deploying digital technologies to enhance safety and operational efficiency while strengthening our human resources,” said Terdkiat. “Innovative energy materials aligned with global megatrends will be the key to overcoming challenges and achieving our Net Zero goals while balancing business growth, societal contributions, and environmental sustainability.”

2024 Business Performance Highlights

In April 2024, IRPC launched the Ultra Clean Fuel (UCF) project, producing Euro 5 diesel and Jet A-1 fuel in compliance with Joint Inspection Group (JIG) standards to support global aerospace growth. Despite a sluggish petrochemical market, the company committed to increasing its portfolio of innovative and specialty products by 36%, focusing on high-potential markets such as packaging, medical, electric vehicles, and electronics.

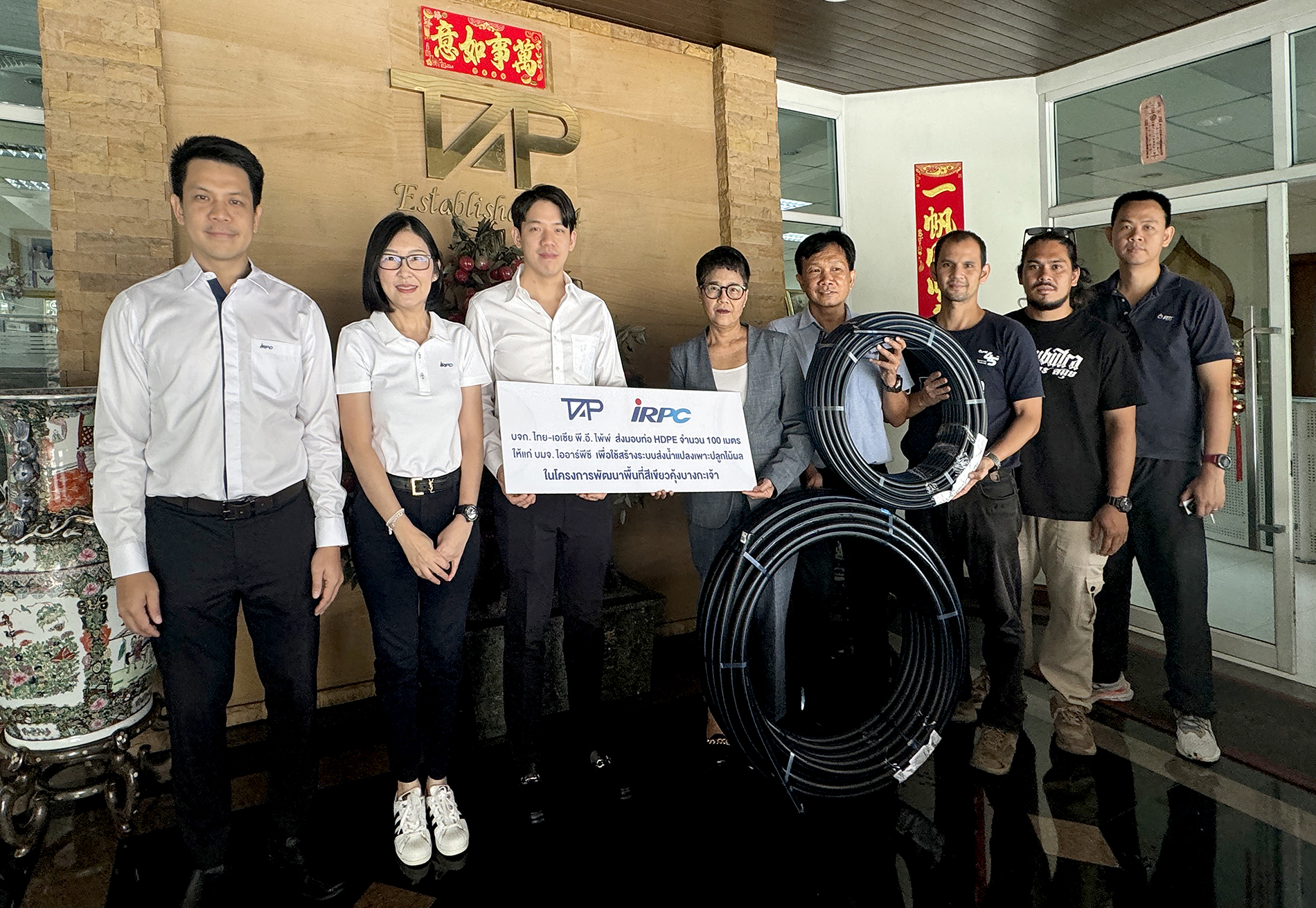

The company also expanded its clean energy initiatives with an 8.5-megawatt increase in floating solar capacity (Phase 2) and the development of a solar power plant on its estate, supporting Thailand’s push for sustainable energy.

Economic and Operational Challenges

The year 2024 presented significant obstacles, including geopolitical conflicts, rising inflation, and volatile energy prices, which affected global economic expansion. A decline in crude oil prices and sluggish economic outlooks in China, the USA, and Europe further pressured IRPC’s performance. Net sales in 2024 fell by 6% year-on-year to THB 281.711 billion due to a 4% drop in sales volume and a 2% reduction in average crude oil prices.

IRPC reported an inventory loss of THB 2.496 billion or USD 0.98 per barrel and a net inventory loss of THB 664 million or USD 0.25 per barrel. EBITDA was THB 4.476 billion, down 22% year-on-year, while net finance costs increased 20% due to rising interest rates and borrowings. Despite these setbacks, IRPC recognised a profit of THB 989 million from its investment in WHA Industrial Estate Rayong Co., Ltd., which contributed revenue from land sales.

In Q4 2024, IRPC recorded a net loss of THB 1.125 billion, a 77% reduction from the previous quarter, despite challenges from depreciation, asset impairments, and losses from currency depreciation and derivatives.

Outlook for 2025

The petrochemical business remains at risk from a supply glut due to new production capacity in China, while demand is expected to grow modestly by 1–3%. High-potential sectors like food packaging and technology products are expected to grow, while durable goods such as housing and automobiles may experience slower demand.

Key factors to monitor in 2025 include US trade policies, geopolitical conflicts, and environmental regulations in the EU that may enforce import controls on high-greenhouse-gas-emitting products, including petrochemicals. Businesses must adapt to comply with these evolving regulations to remain competitive.

Commitment to Sustainability

IRPC’s ongoing commitment to sustainable business operations is reflected in the numerous awards and recognitions received in 2024. The company has been a Dow Jones Sustainability Indices (DJSI) member for 11 consecutive years in the Oil & Gas Refining and Marketing industry. Additionally, IRPC is the first and only private organisation in Thailand to receive the GOLD Award from the Ministry of Justice as a model organisation for human rights.

The company also achieved Excellent CG Scoring for the 16th consecutive year from the Thai Institute of Directors Association (Thai IOD), reinforcing its commitment to good corporate governance.

Dividend Payment

The Board of Directors has approved a dividend payment of THB 0.01 per share, totalling approximately THB 204 million, subject to shareholder approval at the general meeting on April 2, 2025.

Live Stream

Live Stream