2567-06-25

IRPC and SCB Sign Sustainability-Linked Forward Contract

Collaboration highlights cost management to drive sustainable energy.

IRPC, led by Phichin Aphiwantanaporn, Senior Executive Vice President of Corporate Accounting & Finance, along with Somruidee Charoenkrongsakul, Acting Senior Vice President of Corporate Accounting & Finance, in collaboration with Siam Commercial Bank (SCB), led by Soramon Inkatanuvatana, First Executive VP-Corporate Banking 1 Function, and Patrick Poulier, Executive Vice President & Head of the Financial Markets Function, signed an MoU to initiate Sustainability-Linked Forward Contracts aimed at preventing foreign exchange risks and promoting sustainable development.

This collaboration is marked as a financial innovation where costs are based on Environmental, Social, and Governance (ESG) performance. The Sustainability-Linked Forward Contracts are set to align the business plan with the organisation’s sustainable development goals, good governance, and the use of renewable energy.

Phichin Aphiwantanaporn, Senior Executive Vice President of Corporate Accounting & Finance at IRPC, stated, “IRPC’s collaboration in Sustainability-Linked Forward Contracts reflects the company’s commitment to environmental, social, and corporate governance. IRPC aims to meet sustainable development needs, which are integral to our strategy and business practices. Moreover, this transaction helps the company mitigate risks associated with exchange rate operations and enhance cost management.”

Patrick Poulier, Executive Vice President & Head of the Financial Markets Function at Siam Commercial Bank, stated, “SCB is committed to driving a sustainable society with the aim of achieving Net Zero. Based on our internal operational plan for 2030 and our lending and investment plan for 2050, the bank is delighted to support IRPC in achieving corporate growth while caring for society, communities, nature, and the environment. The Sustainability-Linked Forward Contracts address financial cost management linked to exchange rates and interest rates through ESG performance.”

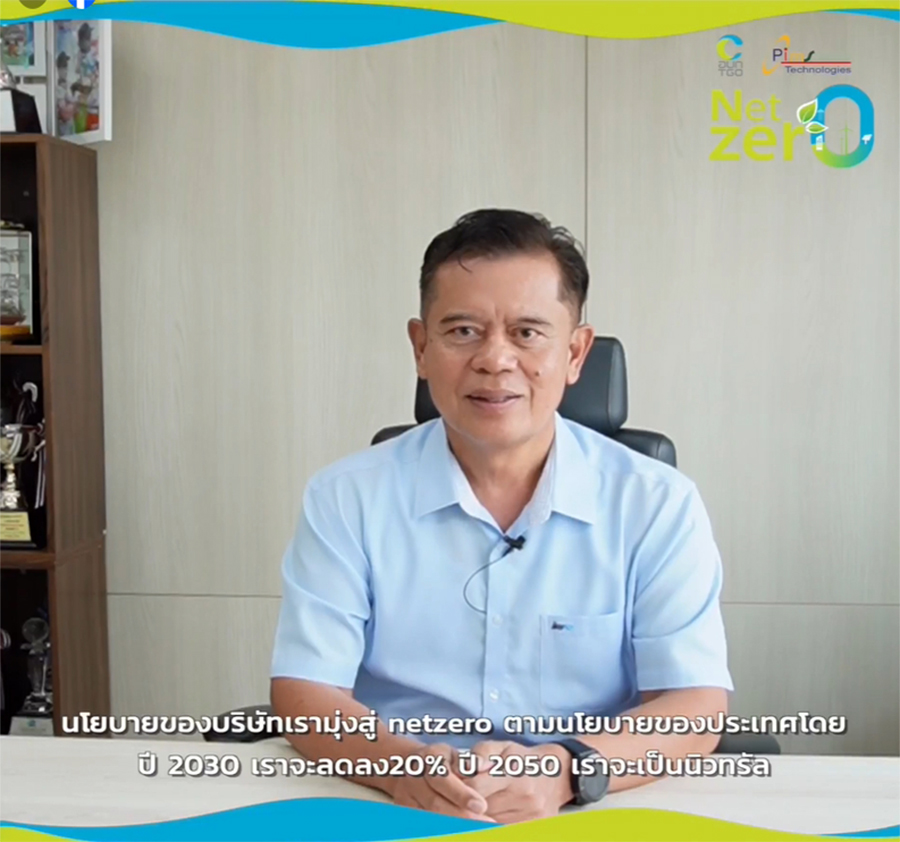

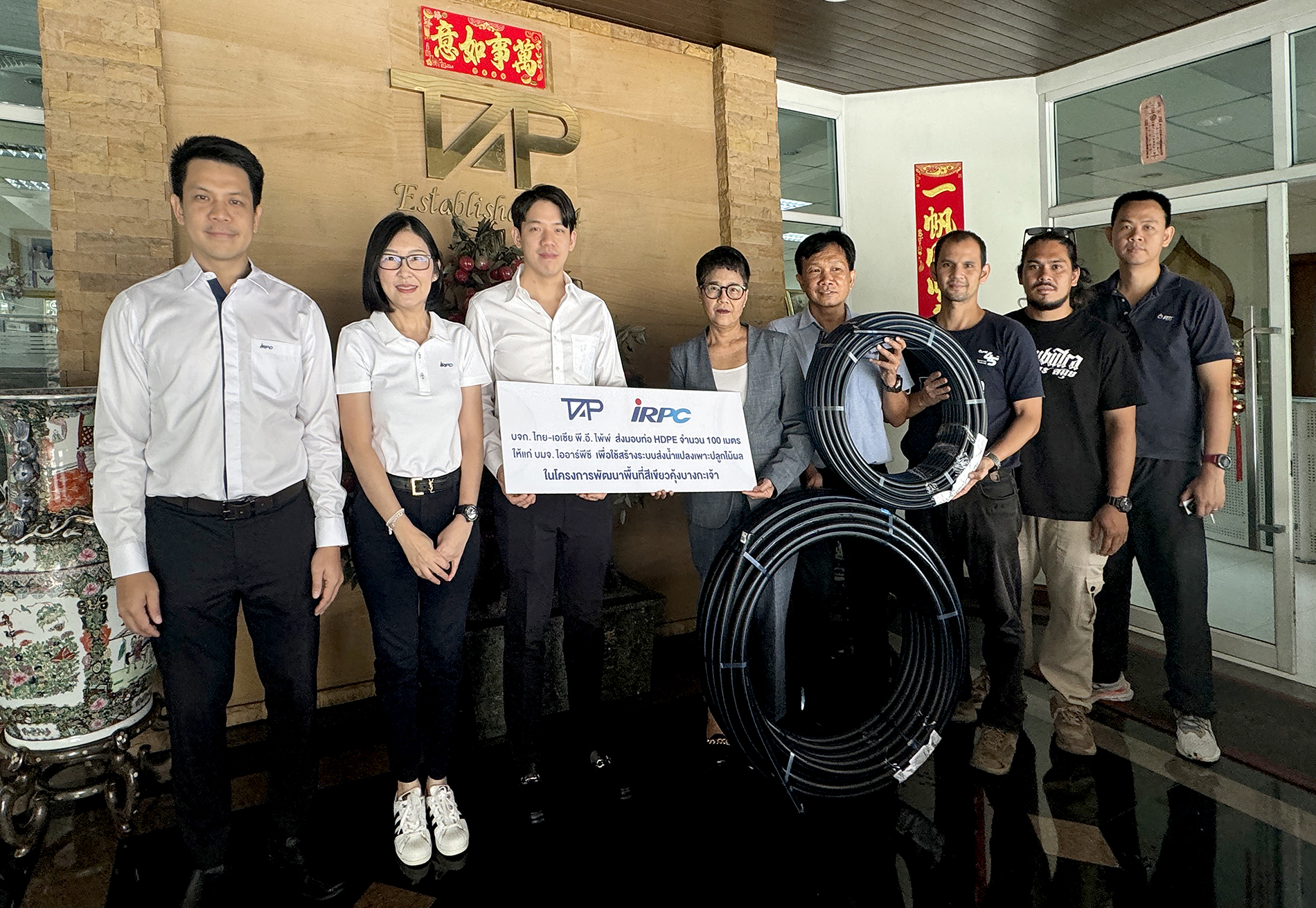

Live Stream

Live Stream